Russian recycled containerboard (RCCM) prices rose in September, while kraftliner prices remained unchanged, while kraft producers announced price increases for October. Despite Western sanctions and Russian citizens' concerns about the future, domestic packaging demand in Russia improved slightly in August and September compared to the first two months of summer. This demand, together with expensive recovered paper, is supporting price levels for all containerboard grades.

In September, recycled containerboard manufacturers, which were on the verge of losing money last month, announced an average price increase of 11,000 rubles/ton. With the prices of bleached kraft and semi-chemical corrugated in the range of RUB 38,100-42,650/t, the price gap between recycled containerboard and virgin grades has become very narrow. The price of white top kraft linerboard remained stable at around 74,000 rubles/ton.

It looks like the market has recovered slightly. Traditionally, demand for corrugated packaging also increases once vegetable season begins, followed by grain harvest and winter holiday shopping. In addition, import substitution policies are also affecting consumer activity and containerboard demand. Locally produced goods require packaging, which drives demand even in a downturn.

The pressure of high waste paper cost has been pushing up the price of recycled containerboard. In September, the price of recycled containerboard in Russia rose from 8,000 rubles/ton to more than 14,000 rubles/ton, with an average of around 11,000 rubles/ton . Meanwhile, old corrugated containers (OCC) were traded at around RUB 18,000/t, unchanged from the last week of August. However, at auctions of supermarket chains, prices sometimes reach RUB 20,000/t.

While high recovered paper prices are still one of the main reasons for the rise in recycled containerboard prices, a lack of inventory is also said to be a factor behind the rebound in demand and price increases of more than 35%. Packaging manufacturers have very little paper supplies on hand. While the price fell, no one wanted to buy extra quantities in the hope of getting it cheaper later. Their inventories are now low, which also helps demand. The situation in early September was difficult as producers struggled to source enough containerboard.

Prices of virgin paper remained stable in August, but producers had announced to customers in September that they planned to raise prices starting in October, and the upward trend is expected to continue until November. As the price gap between recycled and unbleached kraftliner is less than 10%, some packaging producers may consider switching between grades.

According to one corrugated packaging producer, the shift could be particularly beneficial for packaging producers of products that require moisture-resistant packaging, such as meat. However, their goal is not to take market share away from the recycled containerboard manufacturers, their current strategy is only to increase prices and ensure profitability. Demand for white-faced linerboard was also reported to be good in September, with demand coming from locally-made beverage packaging as well as domestic disposable cups. In September, raw paper producers continued to face difficulties in export logistics. Due to the Russian-Ukrainian war, some trains were diverted, which may prolong the delivery time.

The Chinese market, which used to be very attractive for exports, is still slow and some producers have reportedly had to stop work. In theory, containerboard under Russian customs code 4805, including kraftliner made from semi-chemical kraft pulp, could be exported to Europe, but apart from logistical complications, the lack of FSC certification makes it Not attractive to European buyers. This could change if energy prices push European containerboard prices up further.

Limited foreign travel opportunities continue to result in more people staying inside Russia, a development that is seen as another reason helping to sustain consumer activity and containerboard demand. However, the Russian government announced on Sept. 21 the first partial military conscription since World War II, and many male residents are leaving the country. Pulp and paper industry sources say it is too early to predict how the situation will develop and how the containerboard market will be affected. According to local media reports, industry may ask the government to allow employees to be exempted from military mobilization.

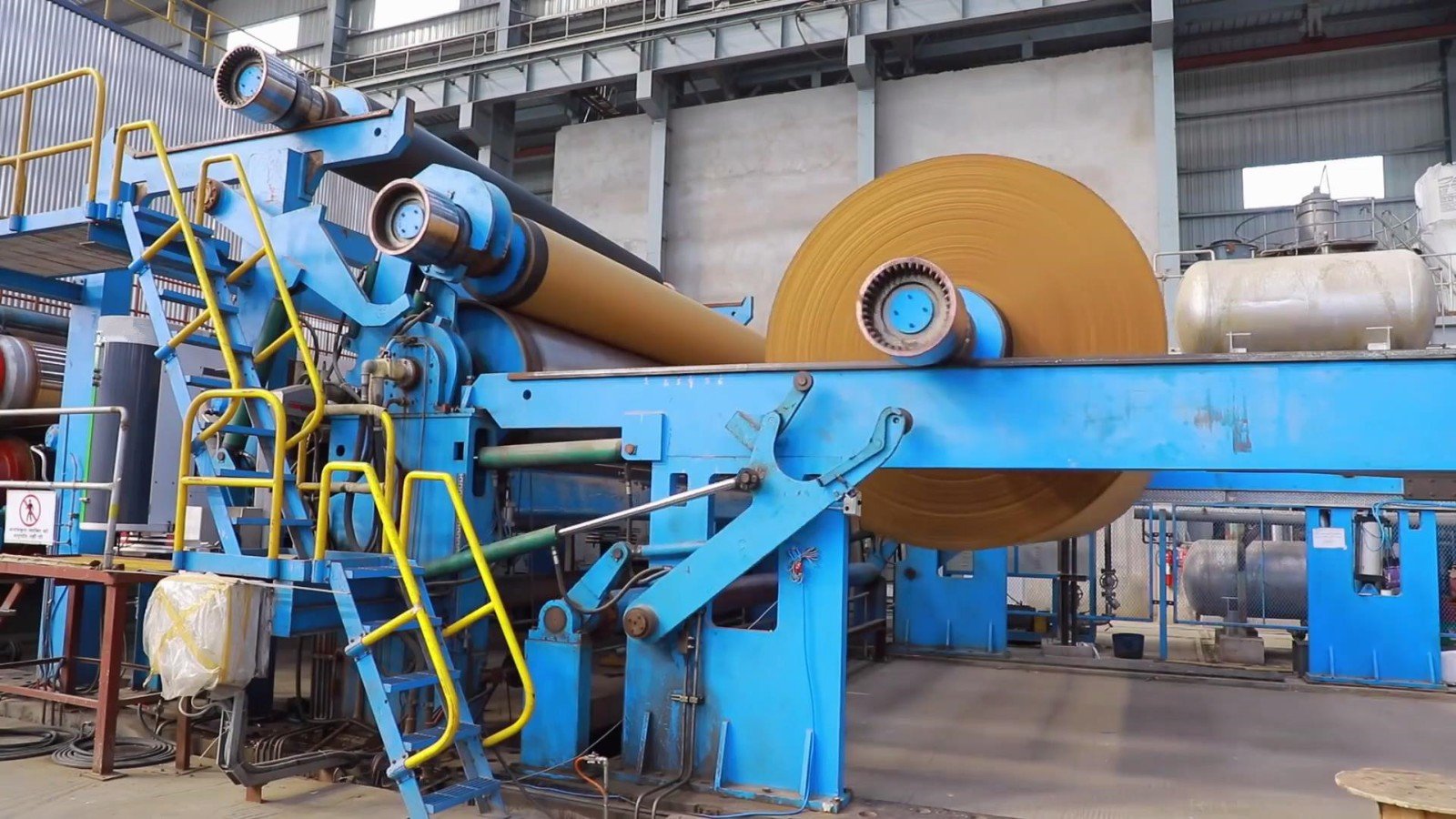

YIDAFA is one of paper pulp machine and paper making machine manufacturers in China.Recycled waste carton pulp kraft corrugated paper making machine is one of the main products.